Recent Blog

**Worried about the fall in FD rate? Here are four alternatives**

The interest rate offered by fixed deposits were already moving south, and major banks have yet again cut their FD interest rates.

Banks like SBI, HDFC Bank and Kotak Mahindra Bank have cut their FD interest rates. SBI has sharply reduced the interest rate on fixed deposits between from 45 days to 10 years by 50-75 basis points.

This rate cut comes on the back of the cut in the repo cut by the Reserve Bank of India (RBI). RBI has cut interest by 75 basis points since January 2019. One basis point or bps is one hundred of a per cent.

Fixed deposits are ‘the’ favorite saving avenue of Indians. And, now the fall in the FD interest rate has hit FD customers, especially for retired and people who are near their retirement. As a result, it has become the need of the hour to look at better alternatives to bank FDs.

Here are some of the investment options that may help you in the current scenario.

**Small finance banks FDs**

Smaller finance banks offer higher interest rates than bank FDs. These banks have a regional presence and may not have pan India presence like major banks. Small banks rely on deposits from customers to expand their loan book. As a result, unlike these banks offer higher interest to attract customers. E.g., Jana Bank offers an interest rate of 8.50% on their one-year deposits while the current rate one-year FD of SBI is 6.80%.

Many people fear to park their money with these banks. However, the deposits of up to Rs.1 lakh in these banks are insured. This is similar to other big banks. It is better to do a little bit of background check before opening FD in these banks.

**Post office time deposits**

The interest offered by the post office on their time deposits is a tad higher than bank FDs. E.g. the interest rate of 1 to 3 years PO time deposits is 6.90%, which is higher than the rate given by major banks. For 5-year FDs, the post office is offering 7.7% while SBI FD is giving 6.5% per annum. Also, post office saving deposits carried with a sovereign guarantee on both capital and interest earned. While bank FDs change their rates as and when it seems fit, post office FDs are revised every quarter.

**FDs issued by companies or non-banking finance companies**

Many non-banking finance companies and other companies also offer attractive interest rates on their FDs. These company FDs give 1-3% higher than bank FDs. However, the higher interest rate comes with higher risk. Company FDs are not insured and hence carry default risk. In case the company runs into trouble, and the company is not able to pay the principal and interest, it will be hard to get your money back. Hence, do your due diligence or seek help from your financial advisor.

**Debt funds**

In the last few months, debt funds have been news for several reasons. The returns have tumbled striking fears in the minds of many investors. Having said that, debt funds is a strong contender among all the alternatives of bank FDs. It is because debt funds can generate higher real returns and are tax effective. Real

returns are the returns given by an investment product after subtracting the inflation rate. With bank FD rate at 6.5% and the inflation rate is 3%, the real rate is just 3.5%. And if you happen to be in the highest tax bracket, the real rate will come down further.

Historically, debt funds have given better returns than bank deposits. Also, debt funds also come with indexation benefits. This means that tax on the gains is based on the inflation rate of the year. Tax is applicable on the gains that have exceeded the inflation. This helps to fetch better real returns. However, it should be noted that fund houses do not assure fixed returns or capital safety.

These were some of the investment options available to you. Your financial advisor will be able to help you to select the right choice.

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

**Why Should Women Take Charge of Their Money?**

Most women today work in the formal sector and take high-level decisions in their organization. However, it is still seen that when it comes to money and financial decisions, it is yet taken care of by their male family members whether it is their fathers, brothers or husbands.

It is not that the male members know better; women hesitate to make the decisions for fear of being wrong. It is because it is easy to blame someone when things go wrong rather than take ownership.

Many times, it is seen that the wife does not have a single clue of her husband’s investment, and it becomes a confusion after divorce or after the death of the husband. Hence, women need to take care of their finances. Women also need to save more than their male counterparts.

While income discrimination among men and women are decreasing, still many women are paid less than their male counterparts. This also affects their future growth potential. Women also shoulder the responsibility of their family’s take carer and take breaks when they become a mother. As a result, they have fewer working years than men. It also limits their earning potential. Also, the life expectancy of women is higher than men. That means that women will outlive their husbands.

Managing money may seem an uphill task for many women. But it is not so. Knowing what you want from your money is the central question that women need to ask before they start managing their money.

One way to take control of your finances is to take the help of a financial advisor. This will boost your confidence, and you can easily make your investment decisions.

However, saving and investing will mean different things to different women, depending on their life stage. The goals and aspirations of women in their 20s will be very different from women who are in their 40s. A woman in her 20s is most likely to save money to travel and plan for her dream wedding. Children’s higher education may be the top priority for a woman in her 30s and 40s. Also, the risk taking capacity will vary according to their age. Hence, it is essential to consider the age, financial goals and risk-taking ability before you start investing.

When you are single, and in your 20s, you don’t have too many financial responsibilities and the whole life awaits in front of you. As a result, you can take exposure in high-risk instruments such as equity mutual funds to fulfil your long-term goals such as buying a house or retirement. If you want to invest in a dream wedding, you can park your money in a short-term debt fund.

If you are in your 30s, children’s education may be one of the main priorities. Depending on the timeline of your children’s education, you can easily plan for the same. If it is for higher education, which is 7 to 10 years down the line, then equity funds would be the preferred option. Hybrid funds can be useful if the time horizon is around five years.

Women make sure that everyone around them is happy. However, it is seen that women forget to take care of themselves. While men think and invest for their retirement, retirement planning among women is extremely rare. Women can start planning for their retirement with their husbands. Retirement planning is vital for women because the average life expectancy of women is more than men. With inadequate savings and lack of social security in India, women have to depend on their children to get their needs met. Hence, building retirement corpus throughout the different life stages can help women to live a dignified life.

To summaries, leaving money matters in your husband’s or father’s hands may not be the right approach. Take control of your finances, and if you need help, a financial advisor will be able to help you.

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

Have you ever got stuck up in traffic? I am sure you have. Just imagine your car is new brand with powerful engine, but unable to move an inch because of heavy traffic. And you get what? Frustrated! What happens when you cannot move but the smaller cars in lane next to you is moving faster than you because that lane has lesser traffic than the one in which you are driving. More Frustration! Right?

As a human being it is obvious that you would have strong urge to change the lane and move to the faster lane. And using your driving skills you change the lane. The moment later the lane which you left start moving and the new lane in which you entered stops moving due to traffic. Now what? Height of frustration!

If there is a smile on your face while reading this, it means you have already have experienced it, probably not just once but more than once you have changed the luminously reached the height of frustration.

Not just driving whenever in our life when we see someone is moving faster than us, we try to change the course and find ourselves caught in trap and then feels like we should have stayed in our lane.

**Changing Mutual Fund scheme based on Past Performance **

So is the case with Mutual Fund schemes. Most investors after investing in mutual fund scheme start comparing the return of their schemes with that other mutual fund schemes. And many a times we change the mutual fund schemes and switch our money into other better performing mutual fund scheme in recent past. And what happens next?

In recent times, Past Performance has become a major criteria of the mutual fund selection system. Investing based on recent past performance is as risky as driving a car by looking only into rear view mirror. While driving, rear view mirror is useful but more than rear view it is your front view which is more important for smooth and safe journey.

Past track record definitely helps in understanding the quality of scheme and ability of management team but recent past performance is not the guarantee for the future.

**What else matters while selecting scheme?**

Apart from Recent past performance, one should look at consistency of return which can be derived from rolling return analysis for various periods, which requires lot of data crunching rather than just finding out the past one-year return.

One should also look at how fund has performed during the best and worst period in past compared to its benchmark and category return.

You also cannot avoid looking at risk parameters. If some fund is generating superior return, then it is also necessary to check at what cost. How much risk or volatility is it adding into portfolio.

Choosing fund from the basket of hundreds of funds requires lots of data, analytical skills, education and experience. One can do it by own but it is very risky. It’ is always advisable to take the help of qualified professional for building quality portfolio and stick to it with discipline.

Frequently changing lanes rarely helps, in driving or investing.

Happy Investing!

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

**Why you should get term insurance right now?**

We all love our families and want the best for them. We try to fulfil their wishes to the best of our abilities. One easy and simple way to show your love for your family and to make sure that they continue to live a dignified life even in your absence is to take a term insurance.

Life is unpredictable, and there will be times when things don’t go according to the plan. Term insurance is one of the simplest financial products which can safeguard your family in times of an unfortunate event.

Getting insurance is the first and most crucial aspect of financial planning. In term insurance, the beneficiary receives the sum insured after the death of the insured person. However, one needs to remember that the term plan does not pay back any amount if the insured person survives the tenure of the policy. You can avail higher life cover by paying a lesser premium.

**Who should take term insurance?**

If you have dependents whether it is your spouse, young children or elderly parents, taking insurance is necessary. However, even if you have no dependents, but have outstanding loans like home loan or vehicle loans, taking term insurance is also essential in this scenario.

It is beneficial to take term insurance at the earliest because the premium paid and the age of the insurer is directly proportional. This means that longer you wait to get term insurance, the higher will be your premium. The premium is likely to increase as the number of responsibilities and health issues may crop up. Also, unlike health insurance, where the premium covered keeps on growing, the premium for term insurance remains the same throughout the tenure.

**What should be the ideal insurance cover?**

Figuring out the ideal insurance cover is one of the most important things to consider when taking a term insurance cover.

A cover of Rs.50 lakh may be sufficient if you don’t have dependents. But it will not be enough after you have a family. You will have to increase your cover after every significant event like marriage, the birth of the first child and second child etc.

As a thumb rule, life cover should be equivalent to 10 times of your annual income. However, that is just the tip of the iceberg. Loans and debts, future expenses, savings and investments, are some of the other factors that should be kept in mind while calculating the insurance cover. The outstanding dues on your home loans and vehicle loans should be considered in the term insurance. However, you don’t have to calculate your credit card debt in this scenario.

The other important part is providing for future expenses such as children’s education, marriage and day to day expenses. Consider a reasonable inflation rate while calculating future costs. You may also be investing in these goals through systematic plans in mutual funds, but it is essential to consider these goals as accumulating for these goals may come to an abrupt to end in your absence. Having adequate term insurance will make sure that your children don’t have to compromise with their education. You can use a ‘Human Life Value’ calculator available on the websites of insurance companies to find out the ideal life cover for you. Don’t make the mistake of rounding of the amount to the nearest round figure. It is better to take higher insurance cover than to take less insurance cover.

You can take the help of financial advisor to calculate and find out the right amount necessary for you.

Another essential aspect of term insurance is tenure. Many people make the mistake of taking the term insurance to 75 or more. Typically, you should consider term insurance till your retirement age of 60 as the family’s dependency after your retirement will come down drastically.

Term insurance is one of the vital steps in financial planning.

Take one now and relax.

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

Diversification is investing in investment options to limit the exposure to any particular asset class or investment. This practice helps to reduce the risk associated with your portfolio. Simply put, diversification helps you to yield higher returns as well as reduce the risk in your portfolio. Balancing your comfort level with risk against your time horizon is one of the keys to a long successful investing journey. For e.g., keeping pace with inflation may not be easy if you start investing in conservative investment options from a young age. On the other hand, taking a large exposure in high-risk instruments near retirement could erode the value of your portfolio. Hence, it is important to balance the risk and reward in your portfolio so that you don’t lose sleep on market ups and downs.

**What are the components of a diversified portfolio?**

The major components of a diversified portfolio are equity, debt and money market instruments.

Equity investments carry the highest risk in your portfolio and it has the potential to give higher returns over the long run. But with higher return comes greater risk especially in the short run. Equities tend to be volatile than other asset classes. Investing in equity mutual would be the best way to take exposure in equities. Equity mutual funds are diversified funds as fund managers invest in different stocks and across sectors (except sectoral funds) which optimizes the risk in your portfolio.

Another important component of a diversified portfolio is debt securities. While equities have the potential to grow your wealth, debt investments provide stability and act as a cushion through the market cycles. Debt instruments include debt mutual funds, fixed deposits, bonds etc. The main objective of debt instruments is not to provide high returns like equities but capital protection along with inflation-beating returns. Debt investments can also be a source of income.

While equity investments give higher returns and debt instruments protect the capital to help us fulfil our financial goals, a part of the portfolio should be in liquid and money market instruments such as liquid mutual funds or a separate savings account. It provides easy access to money during emergencies such as job loss or accident.

**Why is diversification important?**

Diversification helps to minimize the risks associated with your portfolio. Let us assume that two years ago, you had invested your entire savings in a particular airline stock. Now, the airline is near bankruptcy and the stock price went down 60% in one month. Would you be comfortable in that kind of scenario? Most people wouldn’t. You would have less stressed out if you had diversified your portfolio and invested in a few other companies rather than taking 100% exposure in one particular stock.

Diversification is important because different investment options react differently to the same development or move in a different pattern. For example, real estate and gold tend to underperform when equity markets are soaring. A cut in the interest rate may benefit the bond market but may not be good news for individuals with fixed deposits.

**How to diversify your portfolio?**

Diversifying your portfolio is as healthy as consuming green leafy vegetables, fruits, exercising and meditating on a regular basis. However, eating just one kind of fruit may not be very effective. Hence, it is important to diversify. Investment is no different. Here are some of the ways through which you can

**diversify your portfolio:**

Spread your investments among different asset classes: A diversified portfolio should include equities, debt and cash. Exposure to international market and commodities such as gold can help you in further diversifying your portfolio. It is because different investments come with different risk and returns. Higher the returns, higher will be the risk and vice versa.

**Diversify within individual types of investments:** Diversification is also necessary within an asset class. For e.g. in case of equity mutual funds do not concentrate on one category. It is recommended that you have mutual funds across market capitalization such as large cap funds, mid cap funds and different investment strategies. Different funds and stocks come with varying risks thus minimizes the risks.

**Rebalance your portfolio regularly:** Diversification is not a one-off exercise. Rebalancing your portfolio depends on two important things which are the number of years until you expect to need money (time horizon) and risk-taking capacity (risk tolerance).

To summaries, diversification is important for every investor whether it is across asset classes or within an asset class. The nature of diversification depends on financial goals, time horizon and risk tolerance. It is also important that the diversification of the portfolio is updated on a regular basis.

A Friend, “Your Financial Life Partner”

97128 63430 – 86553 06591

Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD

921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007

info@finoptical.com | www.finoptical.com

Read More →

**ELSS vs PPF: Which Tax Saving Instrument Is Better**

“But in this world, nothing can be said to be certain, except death and taxes.” Benjamin Franklin

While we can’t get clever with death, we can be smart with taxes and save our hard-earned money. One can save tax by investing in various instruments such as Equity Linked Savings Scheme (ELSS), Public Provident Fund (PPF) and National Pension System (NPS) and tax saving fixed deposit etc.

Out of these tax saving options, ELSS and PPF are the most popular. Investment of up to Rs.1.5 lakh in a financial year in these two options among others qualify for tax deductions under Section 80C of Income Tax Act 1961.

Have you invested in PPF or ELSS? In this article, we will compare these two tax saving instruments which will help you to figure out the right one for you.

**Lock-in Period:** Both ELSS and PPF come with a lock-in period. ELSS funds have a lock-in period of three years while PPF comes with a 15-year lock-in period. However, in PPF, you can make partial withdrawals after the seventh year. Hence, we see that ELSS has a shorter lock-in period than PPF. This means that you can redeem the ELSS fund’s units after three years. However, it is suggested that you do not redeem it, as by being invested your capital will appreciate over time.

**Returns:** The returns is one of the key factors that distinguishes PPF and ELSS. The government of India fixes the interest rate of PPF every quarter. On the other and, the returns in ELSS are not assured and is linked to the equity market. If we see the historical performance of both the two options, ELSS funds, in the last ten years has given returns of 13.55%* while the interest rates in PPF have ranged from 7.6% to 8.8%.

According to research by Value Research, an investment of Rs.1.5 lakh every year over the last 20 years, have grown to Rs.79.39 lakh in PPF. While in the same time frame, investment in ELSS has increased to 2.28 crore. Hence, in terms of returns, ELSS has outperformed PPF.

**Investment amount:** In case of PPF, you can only invest up to Rs.1.5 lakh in a financial year. However, there is no such restriction in the case of ELSS. While the tax benefit will apply to Rs.1.5 lakh, you can invest more and earn returns on the entire investment amount. As a result, ELSS is also a popular option to plan for long term goals.

**Taxation:** Gains from ELSS funds are taxed as per the equity funds and is subject to short term and long-term capital gains. Short term capital gains are applicable if the units are sold before the 1st year. In this scenario, a tax of 15% will be applicable. If the units are held for more than a year, gains up to Rs.1 lakh in a financial year is exempted. If the gains are higher than Rs.10 lakh, long term capital gains will be applied in ELSS funds.

On the other hand, PPF falls under the EEE (Exempt, Exempt, Exempt) category. This means that the interest earned by investing in PPF and the principal amount is exempted from taxation.

**Conclusion**

By now, you may have become familiar with the differences between PPF and ELSS. PPF is the darling of Indian masses, but its long-term performance is not attractive while ELSS funds have given attractive returns. Also, with the interest rate trending down from 8% to 7.9% (July-Sep 2019), it is unlikely that PPF will give a better return.

ELSS is not only a tax saving instrument; it can also help you to achieve your long-term financial goals such as retirement. It is because you can invest over and above the Rs.1.5 lakh mark and still earn returns on the entire corpus.

If you have just started working or have no exposure in the equity market, you can invest in ELSS funds. Once you are comfortable with ELSS funds, you can start investing in other equity funds to achieve your financial goals.

In case of any queries, please get in touch with a financial advisor. He or she will be able to help you out with the best ELSS funds.

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

Personal finance is everything to do with managing your money and saving and investing. We are sharing series of articles where we shall discuss 9 useful personal finance concepts which everyone should know and learn.

In this first part we shall understand Risk.

Risk, word itself creates a sense of fear in mind. We all want to avoid risk, but unfortunately, we cannot. Risk is everywhere. We cannot avoid it and that’s why we must understand the risk and learn the ways to manage it. Being cautious and taking necessary steps to manage risk is better than living in avoidance behavior.

**Inflation Risk:**

All investment products carry risk, even Fixed return products carry risk. Risk of getting negative real return.

**Real Return = Nominal return – Inflation**

In real world the inflation is much higher than the data published by govt agencies. In personal finance, the definition of inflation should be, a rate at which your expenses are growing yearly due to price rise and change in life style. With increase in lifestyle expenses and constantly decreasing interest rates, fixed return products hardly can give any real return after adjusting effect of inflation.

**Market Risk:**

Definition of market risk is ‘Risk of losing money due to market correction or due to falling prices of security bought in portfolio.”

In case of equity as an asset class market risk is less in longer term compared to short period. Probability of Sensex or Nifty going down is more in 1 year compared to 5 years. And it is lower in 10 years compared to 5 years.

**Managing Risk:**

To manage risk in your portfolio you need to adequately diversify your investments in equity and debt.

Your short-term investments should be more towards fixed income category as the risk of inflation will not harm the value of portfolio much in short term. The risk of inflation is much higher in long term as it’s compounding effect can erode the purchasing power of your money considerably in long term.

Your long-term investment should be more towards equity as the market risk is lesser in long term compared to short term. In long term equity can give you much better return compared to debt and save your portfolio from inflation risk.

Remember, He who is not courageous enough to take risks will accomplish nothing in life.

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

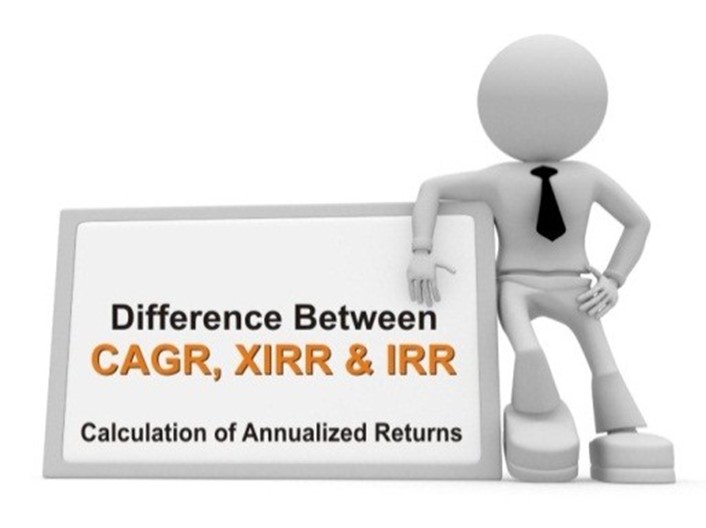

**Understanding Return**

Calculating return would have been easier, if we had been investing exactly for one year. But that doesn’t happen in practical world. Investment is normally done in staggered manner and each investment is not kept for same period of time. Withdrawal also might happen over a period of time.

To compare the return from various investment plans, it is necessary to have a common parameter which can be used for all types of investments with different investment amounts and different holding period. That common parameter is to assume that all investment returns get compounded annually.

If investment is held for lesser than one year, then we need to calculate the return in percentage terms by assuming that the investment is held for one year.

**CAGR – Compounded Annual Growth Rate**

If you want to calculate the return for one time investment then CAGR (Compounded Annual Growth Rate) is used. But when the investment is done periodically or staggered over a period of time, CAGR is not useful to calculate the return.

In case of staggered investment, either IRR or XIRR can be used.

**IRR – Internal Rate of Return**

If the investment is done in strict periodic manner, you may use IRR to find out the rate of return. For example, if investment is done at fix interval (Monthly/quarterly/yearly) and withdrawal only at the end of the entire tenure, IRR can be used to find out the return.

**XIRR**

If cashflow includes frequent inflow as well as outflow over a period of time, we need to use XIRR for calculating the rate of return. XIRR gives you the flexibility to assign specific dates for each cash flow, making it a much more accurate calculation Though Return is one of the most important criteria but we should also look at other parameters like consistency, portfolio quality, risk, risk adjusted returns etc.

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

As the classic proverb says, ’Don’t put all eggs in one basket’, Investor also must diversify his/her portfolio into different asset classes. Why? Reason is very obvious – to reduce the risk.

There are mainly 5 asset classes, namely; Equity, Debt, commodity, real estate and cash. One must allocate his/her savings into different asset classes based on the various parameters and their own risk appetite. Dividing your investment in different asset class based on different parameters, is called asset allocation.

Considering ease of investing and liquidating, we shall focus on two asset classes – Equity & Debt, to understand the process of asset allocation.

**Deciding right Asset Allocation Mix:**

One of the most important criteria while selecting the asset class is time horizon.

∙ Short Term - If you are looking to invest for less than 3 years, your portfolio should consist of mainly Debt investment as equity is very volatile and market risk is higher in short term.

∙ Medium Term - If you are looking to invest for a period of 3 to 5 years, your portfolio should be mix of equity and debt both.

∙ Long Term - In case of investment for longer than 5 years, you can invest more into equity. Equity as an asset class is lesser volatile in long term.

**Rebalancing Asset Allocation:**

Investment horizon keeps on changing over a period of time. So as the years passed by, asset allocation needs to be re adjusted based on the remaining numbers of years till you need to withdraw. So, for example, if you are going to need money in year 2027, you must start shifting money gradually from equity to debt by year 2024.

**Other important Parameters:**

Risk appetite, required rate of return to achieve your financial goals, tax implications etc. are other parameters which are also crucial while deciding the right asset allocation mix.

One must be able to control GREED in bull market and FEAR in bear market to ensure the right asset allocation mix in the portfolio. One must be focused and disciplined to save from the emotional decisions which might deviate himself/herself from the asset allocation.

**“Most important key to successful Investing can be summed up in just two words Asset-Allocation.” Michael LeBoeuf **

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

**Here’s How to Select the Right Type of Mutual Fund**

We all love to have choices in different aspects of our life. Whether it is books, clothes or career, options are essential. Everyone has different inclinations and tastes, and hence, selecting the right choice is utmost vital.

Similar is the case with mutual funds. Mutual funds also come in various shapes and sizes to suit every investor and make their dreams come true. No matter what kind of investor you are or your goals are, there will be a mutual fund for you. But finding the right type of mutual fund may not be easy for a lot of new investors.

Mutual funds can be classified into various categories based on its assets, options etc. In this article, let us try to understand these types of mutual funds that will help you to find out what will suit you the best.

**Based on asset class:**

Equity and debt are two major types of assets where mutual funds invest. They have different objectives. While equities are mostly for capital appreciation in the long term, the aim of the debt is capital protection along with moderate returns.

There are three different types of mutual funds based on the asset classes: equity funds, debt funds and hybrid funds.

The type of fund that will suit you the best will depend on your investment horizon. For example, if you want to buy a house in 15 years, then 15 years is your investment horizon. In another instance, if you are planning for an exotic vacation in less than a year, then one year is your limit.

For long term goals of five years and more, equity fund is the best option. Equity funds tend to be volatile in the short run, and the risks are evened out in the long run. Debt funds are good investment options for short term goals of around three years or less. For your financial goals of 3 to 5 years horizon, hybrid funds can be the ideal category.

**Open-ended and close-ended funds:**

A fund remains open for initial subscription for a limited number of days during its launch. It is the new fund offer (NFO) period. In close-ended funds, investors can only invest during the NFO period. Close-ended funds come with a specific period of say three years. Also, investors do not have the option to invest more or exit during the period. After the period is over, investors have to redeem the mutual fund units. Also, systematic investment plan (SIP) is not available for close-ended funds.

Open-ended funds do not have these limitations. These funds remain open for entry and exit, making it an ideal choice for goal planning. It helps you to adjust your goals according to your life stage. It allows prioritizing your goals. For example, buying a home is your priority; you can invest more and increase your SIP regularly. Once, you reach your target amount, you can easily redeem your units. You do not have to wait for the maturity date. Hence, an open-ended fund is a better option than a close-ended fund.

Growth and dividend options

**Fund houses also offer two options:**

growth and dividend option. In the growth option, the fund reinvests the profits back in the fund. As a result, the net asset value (NAV) of the fund keeps on rising as the scheme gains. This helps you to take advantage of the power of compounding. In the case of dividend option, investors get the profits declared by the fund. Hence, the NAV comes down as and when the dividends are declared.

The growth option is better to build wealth over time and fulfil your financial goals. And if you're looking for a regular income source, then you can choose a

systematic withdrawal plan (SWP) instead of dividend option. In the case of SWP, you receive a fixed sum of money regularly, and the remaining corpus in the fund will continue to grow.

Hence, go for growth option to fulfil your financial goals.

**Conclusion:** We have seen that the category and type of fund that you need to select depending on your financial goals. Moreover, the growth option in open ended funds is a better option for investors. It gives the benefits of compounding, along with liquidity.

To know more, consult your financial advisor.

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

**The three systematic ways to manage mange your investment and withdrawal:** Raise your hand if you have ever heard about SIP? However, do you know everything that you should know about SIP? In this article, we will dig deep to understand how SIP works. Also, there are other systematic plans like STP and SWP that can help you to plan your finances in the long run.

Let’s go one by one in detail:

**Systematic Investment Plan (SIP)**

Most people assume that systematic investment Plan or SIP is different from mutual funds. It is common to hear people say that they have invested in SIP and not mutual funds because SIPs are less risky.

There are two ways to invest in mutual funds: one-time investment (Lump sum) or staggered automatic investment at regular intervals (SIP). SIP is just a way to invest in mutual funds. The underlying risk, stocks or securities remain the same.

Systematic Investment is an effective investment option for salaried people. Once you set up a SIP, whether it is monthly, quarterly etc., the SIP amount will be automatically debited at the pre-defined intervals from your savings account.

One of the most important advantages of SIP is the benefit of rupee cost averaging. Rupee cost averaging helps to take advantage of rising markets as well as falling markets. As the monthly investment is fixed, the fund house will allot you fund units according to your investment amount. When the market is up, the price of a mutual fund unit will also go up. In this scenario, you will be allotted lesser units. And, when the market is down, you will be allotted more units. This helps you to gain more when the market gains.

**Systematic Transfer Plan (STP)**

Imagine you find yourself with tons of cash. It may be your fixed deposits maturity amount, a gift from relatives, or a bonus etc. You want to invest but don’t want to invest the entire amount of money at one go. In this scenario, a systematic transfer plan (STP) will help you. Here, you park your money in a low-risk fund, e.g., a liquid fund from which a certain amount will be transferred to another fund, say equity fund periodically. (Daily/Weekly or Monthly)

You can set up an STP for the amount that you like and set a period. STP works similarly to SIP and gives you the benefit of rupee cost averaging. Also, another advantage of STP is that the amount lying in the liquid fund will also give you returns and the value of the liquid fund will increase as well.

**Systematic Withdrawal Plan (SWP)**

Just like you can systematically invest in a fund, you can withdraw from a fund as well. This facility is called the Systematic Withdrawal Plan (SWP). With the help of this facility, you can withdraw a fixed amount of money from a fund at regular intervals say every month. The number of units that will be redeemed will be as per your withdrawal amount. Also, the corpus in the fund will keep on growing.

SWP helps to plan for your retired life. After investing regularly throughout your working years through SIP, you can set a monthly withdrawal plan which will help you to take care of your day-to-day expenses. Once you are near retirement, you can shift your retirement corpus to a less volatile fund, say debt fund and set up the SWP.

**Conclusion:** SIP, STP and SWP are three systematic ways to manage your money. The facility that you need to choose depends on your requirements. If you have further queries, you can get in touch with your financial advisor.

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

Capital safety, the rate of returns, lock-in period and taxation are some of the key features those can help you select between debt mutual fund and fixed deposits.

When it comes to investing, for many of us safety comes first and returns come second. After all, no one wants to play gamble with his or her much hard-earned money. Hence, fixed deposits and gold became our favorite investment options. In this craze of safe investment options, we forget that fixed deposits may not be the most ideal investment option.

However, for investors whose priority is capital safety along with inflation-beating returns can look at debt mutual funds. Debt mutual funds is a category of mutual fund that invests in fixed income securities issued by the various companies and governments.

Now, let us understand the difference between debt mutual funds and fixed deposits that can help you to compare the two investment options and choose your pick accordingly.

**Interest rate/Rate of returns:**

Return from Fixed deposits are fixed and are in the range of 7% to 7.5% currently. While interest rates remain the same during the fixed tenure but it may change through the years. Hence, when you want to reinvest the fixed deposit’s maturity amount, interest rates might be different at that time. With the interest rates moving south, banks may trim the interest rates on deposits going forward.

On the other hand, the returns on debt mutual funds are not assured and are linked to the debt market. Debt mutual funds have the potential to deliver higher returns than fixed deposits as fund managers make investment decisions based on the current debt market scenarios and select papers based on credit ratings and internal research. The expected returns from debt mutual funds are normally the Yield to Maturity minus expense ratio, if one remains invested till the duration of the fund keeping all other parameters same. Also, debt funds stand to gain from the lowering of interest rates as the price of a mutual fund unit i.e. net asset value rises when the interest rate falls.

Debt mutual funds have potential to generate higher real returns. Real returns are the returns given by an investment option above the inflation rate. E.g. if the average rate of inflation in that year was 5% and the interest rate on fixed deposits was 7%, the real rate of return is 2%. A higher real return helps in fulfilling financial goals.

**Capital safety:**

When it comes to capital protection, bank fixed deposits have an edge over debt mutual funds. However, fund houses cannot guarantee capital safety. In the case of FDs, capital protection differs from the issuer of the fixed deposits. Non-banking financial companies give higher returns on fixed deposits but it also comes with higher risk than a bank deposit. Though capital erosion risk is very less in debt funds as the portfolio consist of well researched securities and also due to diversification.

**Liquidity:**

Fixed deposits have a maturity period and you have to pay penalties if you want to redeem your fixed deposits before the maturity date. However, you can redeem from your debt funds anytime you want. However, a few debt funds may have exit loads if you redeem within the specific time frame. Hence, debt funds are more liquid than fixed deposits.

**Taxation:** The taxation structure of debt funds is better than fixed deposits as it comes with indexation benefits. There are two types of taxation on debt mutual fund i.e. short-term capital gains and long-term capital gains. Short-term capital gains are applicable if the units are redeemed before three years and gains are taxed as per the income slab. If you stay invested for more than three years, you are eligible for long-term capital taxation at 20% with indexation. Indexation is nothing but accounting for the rise in inflation. In this case, you only pay tax on gains if the rate of returns is higher than the inflation rate. However, in the case of FD, the entire gains are taxed according to the tax bracket of investor.

**Conclusion:** Debt mutual funds are a good investment option if you are looking for a relatively stable investment option along with inflation-beating returns Investors who are in the higher tax brackets can also look at debt mutual funds for tax

efficient returns.

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

Recently the data published in one of the new websites said that 'New SIP growth falls 61% from April to December.' What does it mean? Does it mean that investment through Sips is no longer attractive? Does it mean that Investors are moving away from SIPs?

There could be only two reasons for fall in Net SIP growth. Number of New SIP registration is slowing down and another reason may be that some investors are stopping their existing SIPs.

Historically it is observed that people start SIPs when the past performance looks good. When market is in bull run people start an SIP expecting the similar return in future. But market can never go up in linear fashion. There are going to be ups and down. Volatility is the part of stock market. So, when market corrects and return in portfolio is negative or not as per expectation people stops the SIP and book the loss.

Remember! In long run correction is temporary and growth is permanent. But when you press the panic button and stop your SIP your temporary loss gets converted into permanent one.

Creation of wealth through SIP requires two elements in place; first good financial advice and second discipline. Returns from SIP is never going to be proportional every year. There would be few volatile years before you create a wealth. Those are the years where Investors needs to stay disciplined and stay invested. In fact, if you want to become even smarter investor you need to increase your SIP amount or add more money in your existing SIP folios. That would help you to accumulate more units and when market recovers your portfolio would grow even faster.

If you had started an SIP of Rs 10000/month in September 2010 in large cap fund (There were 43 Large Cap funds available), value of your investment of Rs 3,60,000 after three years would have been Rs 3,48,896. Many investors were in panic and stopping their SIPs due to this negative return. But those investors who continued their SIP for even one more year, the value of their investment or Rs 4,80,000 was Rs 6,99,858/- after fourth Year.

Market is always going to test your patience. If you lose your patience, you shall not be able to create wealth. Remember what legendary Warren Buffett has said when you are losing your patience, "Successful Investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time: You can't produce a baby in one month by getting nine women pregnant."

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

**Confused between paying off debt and investing? Here’s how to do it**

All of us have financial goals. While some want to buy a house, few would want to travel the world. And there are broadly two ways through which you can fulfil these goals i.e. taking debt and investing.

Taking debt provides instant gratification while in case of investing, you need to wait for some time before it bears fruit.

Debt can eat up a major portion of our monthly salary, leaving us with almost no money to invest for our retirement and other financial goals. Do you find yourself in the same scenario and are you confused about whether you should pay your debt and invest? This is a major confusion that arises in most people’s lives.

Here we will show you steps that will help you to navigate between paying your debts and investing.

**Step 1: Have an emergency fund in place.**

Before you tackle debt or start investing, an emergency fund should be the first step. Think of the emergency fund as a cushion. It will help you to take care if anything unfortunate takes place. E.g., in case of a job loss, you may have a hard time paying your EMIs and managing your family. Hence, in such scenarios, an emergency fund comes handy. Typically, one should have at least three to six months of expenses in the emergency fund.

**Step 2: Check the interest rate of your debt and the expected returns of the investment option.**

As a rule of thumb, you should ideally go with the highest interest or expected returns. If the interest charged on the debt is more than the expected returns from an investment option, then you should look at clearing the debt first. For example, if the interest charged on the credit card debt is 25%, it is less likely that there any investment option that can fetch 25% in the long run. So, in this case, paying off the credit card debt first is a good option.

**Step 3: Does the loan come with any tax benefits**

Loans like student loans and education loan come with low-interest rate along with tax benefits. In this scenario, the effective interest rate of the loan will be lower. Hence, you can check if the investment option gives you the same or more rate of returns. E.g., if the expected average rate of return of 14% over the long run, the interest charged on your home loan is 11%, then opting for investment will help you to grow your wealth.

**Step 4: Decide what you can live with and what you cannot**

There is no one straight solution when it comes to handling money. The kind of debt that one can live with varies greatly. Few may be okay with a home or car loan, but few may cringe on the idea of living under debt. For the latter category of people, paying off debt as fast as possible is the need of the hour. While paying off debt may help to breathe easy, paying off completely may take many years. Hence, if it is going to take a long time, you can look into investing a small proportion.

You can keep a 60-40 allocation towards paying off your debt and investing. If you can manage Rs.10,000 per month, Rs.6,000 can go in paying off your debt and the rest in investment avenues.

It may be a cumbersome process or bank may not be willing to take prepayment every month or for a small amount of money. In this case, you can park this amount in a liquid fund or make a recurring account for six months or so. Once, the amount becomes sizeable, you can use it to prepay your loan. For the rest Rs.4,000, you can set up a systematic investment plan in a diversified equity fund. This help to build a retirement corpus or fulfil other long term financial goals.

To know more about equity funds, consult your financial advisor today.

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

**What’s your retirement plan?**

Let’s play a small game.

Pick the odd one out:

Home

Vacation

Car

Retirement

Education

Dream Wedding

Could you figure the odd one out?

**It is retirement**. You can take a loan for everything else but retirement. Hence, planning for retirement should be on everyone’s top of mind. Starting to plan for retirement as early as possible is the best way as you don’t have to stress about investing a considerable sum of money in the later part of your life.

Everyone’s retirement plan and needs are different. The size of the retirement corpus will not just depend on how much you save and invest, but also how you want to spend after retirement. If you're going to live a frugal life, you may need to accumulate less than someone who wants to pursue expensive hobbies or go on world tours after retirement.

As retirement is a long-term goal, knowing how much to invest in the different phases of your life and how much you should have invested until now are crucial steps in retirement planning. There are various ways to find out how much you should have saved for retirement. One method is the 80% rule. According to this rule, you need to have 80% of your annual salary before retirement for each year. According to another method, you should have saved 50% of your annual income towards retirement by the time you hit 30, two times your salary by 40 years and four times by 50 years.

While these methods can help us to have an idea on how much we need to accumulate as per our life stage, a better way to do so would be to invest a proportion of the monthly income consistently.

**The FOMO generation and millennials**

For the people who are fresh graduates, may feel that retirement is in the distant past. Today, young people believe in having experiences and have a ‘You Live Only Once’ attitude. Many don’t want to invest for their retirement as they think it is a waste of money and the entire invested amount will go down the gutters if they don’t survive till 60. But what if you live?

People in the mid-20s to early 30s can start accumulating their retirement corpus by investing 5% of the monthly income regularly. Investors can start investing regularly in a midcap fund or ELSS funds through Systematic Investment Plan (SIP). Equity funds are recommended as they give higher returns in the long run. As investors in this stage have just started working, their earning potential may be limited. And if they are staying alone in a big city, essential expenses such as rent and food constitute a large chunk of their income. Hence, taking baby steps will go a long way in accumulating the desired retirement corpus.

**The middle-aged people**

In the late 30s and 40s, the earning capacity of individuals increases. By this time, many individuals would have stopped job switching. They are also likely to have one or two kids. While their earning capacity increases, so does their burden of financial responsibilities. Whether it is taking care of their children’s education, paying loan EMIs and insurance premiums, and vacations, all these responsibilities constitute a large proportion of their income. Hence, individuals

who are in this stage should aim to save at least 10% of their income for retirement. Also, one has to keep in mind to top up their investment amount as and when they get an increment.

**Almost near retirement**

In this stage, many of the responsibilities would have been over. It is the time that your kids are most likely to be in college, and they are on the verse to becoming financially independent. Loans are most likely to be out of the picture by this time. With the decrease in responsibilities, you can increase your investment to 15% of your income or more. As an individual approaches retirement, say 55 years, investors can shift their investments to a debt fund. The objective of the debt funds is to protect capital. They can continue their regular investments in the debt fund. This will help individuals to set up a systematic withdrawal plan (SWP) in the debt fund and redeem a monthly sum of money to take care of the day-to-day expenses after retirement.

To summaries, one can gradually increase their investment in retirement. The key here is to start investing as early as

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

If you want to go around the earth and start with 100 meters on first day and double the distance every day, how long do you think it will take?

1 year?

10 Year?

Let’s find out, within 19 days you would have covered 39,321 Kilometers, while the equatorial circumference of Earth is about 40,075 km. you would have travelled around the world in less than 20 Days.

But What if you stop after 10 days? You would have hardly covered a little less than 77 km.

This is the power of compounding. Power of compounding can help you to create a great wealth as well.

How to leverage the power of compounding for maximum benefit to create a wealth!

**Start Early & Invest Regularly**

Key ingredient to avail the benefit of power of compounding is TIME. You need to keep investing regularly for long term. The sooner you start investing in your life, more wealth you will be able to create.

For Example,

Nisha invests 5000 rupees every month since the age of 25, while Nilesh invests 7000 rupees every month since the age of 35. Both of them kept investing till the age of 60 years with the objective of creating a corpus of retirement.

By the age of 60 both would have invested 21 Lac rupees. Assuming a return of 12%,

How much wealth both of them would have created for their retirement?

Nisha will accumulate 2.75 Crore rupees, while Nilesh will get only 1.19 Cr rupees, which is 59% lesser than Nisha’s corpus.

This is why starting early is important.

**Challenge:**

"I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times.” Bruce Lee

One requires a lot of discipline in doing the same things again and again for long term, though it is the most proven method to create a great result in any area.

To avail the benefit of power of compounding the biggest challenge is to keep investing every month with discipline. And as a human being, most of us lack discipline, when it comes to follow same routine with the absence of instant gratification. For creating a wealth in long term, one needs a lot of discipline to start early and keep investing regularly.

**Solution:**

Start an SIP (systematic investment plan) in Equity Mutual Fund for long term to automate the process of investing. You need to exercise your will power just once to decide the amount and tenure to start your SIP. The biggest benefit of investing in mutual fund through SIP is that it helps you in investing with discipline regularly. You need not do paperwork or pay every month manually. This automation makes this long-term powerful process of wealth creation easier for you.

So remember, to avail the power of compounding starting early and remaining invested for long term is the Key.

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

**Know how the power of compounding works**

Imagine a snowball rolling down a mountain. What will you see? As the snowball rolls down the mountain, it gathers snow and becomes a bigger ball. Compound interest does the same thing to our money. Compounding is a simple way that will help you to grow your money at an exponential rate over a period of time.

**What is compound interest?**

Compounding is said to take place when the returns or interest generated on the principal in the first period (a year or a quarter) is added back to the principal amount to calculate the interest for the next period. The process continues until you stay invested. Simply put, compounding means receiving interest on the interest earned in the previous periods.

**Why is compounding important?**

We all work hard to earn money. But is the money working hard for us?

There are two types of interest or returns given by financial products: simple interest and compound interest. Your money will work hard for you if you invest in financial products that work on compounding. Mutual funds and equities help you to compound your investment amount. On the other hand, the interest rate given by your bank on a savings account is simple interest.

Let us see how your initial investment of Rs.50,000 would grow in 5 years at 8% simple interest rate and compound interest.

**Simple Interest Compound Interest**

Initial investment Rs.50,000 Rs.50,000

Years 5 years 5 years

Rate of return 8% 8%

Accumulated corpus Rs.70,000 Rs.73,466.40

Difference Rs.3,466

Hence, we see that through compounding, you can earn more interest and accumulate higher corpus.

**How does compounding work?**

The most crucial factor in compounding is time. It is because as your investments start generating returns, it will help to increase your corpus at a faster rate. The longer you stay invested, the higher will be the effect of compounding.

Let us take an example where Rs. 1 lakh is the principal amount and rate of return is 10%. Let’s see the effect of compounding from a 30-year time horizon.

Years Corpus Growth

5 ₹ 1,61,051.00 ₹ 61,051.00

10 ₹ 2,59,374.25 ₹ 98,323.25

15 ₹ 4,17,724.82 ₹ 1,58,350.57

20 ₹ 6,72,749.99 ₹ 2,55,025.18

25 ₹ 10,83,470.59 ₹ 4,10,720.60

30 ₹ 17,44,940.23 ₹ 6,61,469.63

From the above table, we can see that Rs. 1 lakh grows to Rs. 1.61 lakh at the end of fifth year i.e. gain of Rs.61,000. Later, we see the growth in every five years is higher than the previous period. From 25th year to 30th year, the corpus grows by more than Rs.6.61 lakh in just five years. At the end of 30 years, Rs. 1 lakh becomes 17.44 lakhs, i.e. it has increased by more than Rs.17 lakhs in 30 years.

**How to harness the power of compounding**

We have seen that compounding makes our money work hard and help us achieve corpus. While most of us know the benefit of compounding, we are not able to harness the power of compounding. Here are three steps that can help us make the most of compounding:

**1. Starting Early**

Start as soon as possible. Delaying your investments by even a year will cost you. Hence, it is ideal to start investing when you begin your work life. In this way, you can grow your wealth faster and achieve your financial goals.

**2. Discipline**

When you start investing, it is easy to panic over short-term news or get tempted by a hot stock. This calls for discipline. You need to focus on your financial goals and ignore the noise.

**3. Be patient**

Most of us start investing for quick bucks. But investment is a long-term endeavor. You should not lose your patience if your investments are not growing fast. Some things work best when left undisturbed.

This was all about the power of compounding. To know more, get in touch with your advisor.

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

While investing for any specific goal, we always assume some rate of return from the investment based on some rationale. Actual return may vary time to time from assume return, so it becomes very important to check whether we are getting that return or not. We also need to check how various asset class and schemes are performing in our portfolio. This exercise is known as review and it should be done on periodic bases. Ideally once in a year, you must review your portfolio.

Reviewing doesn’t necessary means frequent buying and selling based on performance. The return which we assume is for the CAGR return for entire period of investment and need not to be equal to assumed CAGR every year.

**How to review your mutual fund schemes:**

You can review the performance of your scheme and compare it with the performance of benchmark. Apart from benchmark you can also compare it with peer group performance.

Performance of good scheme also may lag in some times, so short term performance should not be given too much of weight while doing the review of the portfolio. Rather than short term performance, you must consider long term return and consistency in performance.

Apart from return you also need to compare your portfolio on other parameters like risk, risk adjusted return and quality of portfolio while reviewing the scheme.

If scheme underperforms on all the above parameters, you should exit the same and invest in some other scheme.

But, remember review doesn’t necessary means buying and selling every time while you review. The decision of exiting should not be based on short term underperformance noticed during review. You need to adapt holistic approach of reviewing the scheme by taking in consideration of other important parameters also apart from short term return.

Once you know where you are going by setting appropriate investment objectives, your portfolio review will help you reach your destination. How? By identifying problems and

mistakes that you can correct midcourse. Much like a pilot, your job is to stay on course so that you can reach your destination safely and in a timely manner.

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

**Investing as a newbie**

After one land in a job, the first thing that most parents will tell is to save money. Saving money, especially for someone who is in their first job and living alone in a big city, may not be easy. But it is also not difficult. Saving is necessary as it will help you to tide over emergencies and fulfil your financial goals. Here are a few essential steps that you can take as a beginner.

**Your salary is less than what you get**

We always think that we will start investing once we have enough money. But it is never going to work out this way. One way to change this habit is to imagine that you get less than your take-home salary. For, e.g., You can imagine that your salary is Rs.30,000 if your actual salary is Rs.35,000. Thinking in this manner will help you to save a little amount of money every month.

**How much should I save/invest?**

Knowing how much to save is on everyone’s mind, but there is no easy answer to this question. It is because the lifestyle and needs of different individuals varies. While it may be easy for someone who stays with their parents to save 95% of their income, it may not be the same for someone living alone in a city. As a rule of thumb, it is advised to save at least 20% of your income for your future goals. If you can’t start at 20%, start at 10% and gradually increase your allocation. The main point is to start somewhere.

**What to do with the savings?**

The next question that must have automatically come to your mind would be what to do with the savings. It is better to invest in your financial goals. However, it is most likely that you still haven’t figured out a financial goal. If you don’t have a financial goal in sight, the easiest way to save money would be to set up a one-year recurring deposit.

Investing in an RD is extremely safe and very easy to open. Nowadays you don’t have to fill documents or visit the bank branch. You can create an RD in just two minutes through your bank app. All you have to do is add the tenure, the date on which money will be debited from your savings account, and the sum of money that you want to save every month. Remember to set the date within the first week of the month.

Instead of RD you may also look at Liquid Mutual funds where you get the convenience of withdrawing at any time just like you saving bank account and also get a chance to earn better return than savings account.

Once your financial goals are decided you can channelize your RD money or Liquid fund money into Mutual funds.

**How to invest in mutual funds?**

Mutual funds are an effortless and popular way of investing. Mutual funds invest in a pool of stocks and securities, and a dedicated fund manager manages it. It is especially useful for individuals who do not have the time and expertise to select stocks. To invest in mutual funds, every investor needs to complete the KYC process. The KYC is a one

time procedure. Your financial advisor will be able to help with the process. After the required processes are in place, it is time to select mutual funds. There are many categories of mutual funds for different goals and different types of investors. You should discuss your financial goas and requirements in detail with your financial advisor so that he/she can help you to choose the right product for you.

For e.g., if you want to save money for a vacation that is six months away, taking high risk and investing in equities won’t be the right way to go forward. A liquid fund can help you to save for your vacation. Similarly, for your financial goals that are 15 years away, a small-cap fund may be a good investment option. Ultimately, your financial advisor analyses your requirement, your risk appetite and your financial goals to ensure that you get right schemes in your portfolio suitable to your profile.

There are two ways to invest in mutual funds: lumpsum and through Systematic Investment Plan (SIP). SIP is one of the easiest and convenient to start investing in mutual funds, especially for salaried individuals. In a SIP, a fixed sum of money is deducted every month automatically from your savings account. SIP helps form financial discipline, which allows you to achieve your financial goals. If you have lumpsum amount at hand, you can invest lumpsum in the mutual fund of your choice. You can also invest lumpsum in the fund where you have set up a SIP. This will help you to reach your financial goals faster.

While it is reasonable to have the temptation to spend, it is crucial to save and invest money for the future as well. Investing should be appropriately planned, and mutual funds are one of the best ways to invest your hard-earned money and achieve your financial goals. If you are confused about which mutual funds to invest or how to go about it, a financial advisor can help you in your journey.

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

**6 steps to financial freedom**

Freedom sounds sweet. While we have achieved political freedom way back in 1947, many still struggle with financial freedom. Everyone wants to be financially free and it is not something that is exclusive for just a few people. Having said that, financial freedom is not a child’s play. It is a series of steps.

So, here are some of the steps that you need to take towards financial freedom:

**Set your goal:** Having a goal gives a sense of direction and purpose. You will also be able to track your progress. In this aspect, it is essential to understand what financial freedom means to you. Many associate financial freedoms with early retirement. Here are some of the other instances of how financial freedom may look like:

∙ Freedom to choose a career without worrying about money ∙ Freedom to go on frequent vacations without straining your budget ∙ Freedom to take care of the needs and wants of other people the way you want

∙ Freedom to retire early

**Have an emergency corpus:**

The second step in this journey is having an emergency fund. It is a crucial step, as it will help you to tide over emergencies. No one can predict crises and hence, it is always better to be prepared. Emergencies can include job loss, car repairs, house repairs etc. Without an emergency corpus, you may have to dip into your savings, which may adversely delay your goals. Or worse, take a loan.

Hence, one needs to have an emergency corpus with 3 to 6 months of expenses. The best way to park in an emergency corpus is in a liquid fund. It is crucial to keep in a different account, out of your sight so that you are not tempted to use it.

**Budget**

Having a budget is a crucial part. And this is one step that requires trial and error. A simple yet effective thumb rule is the 50-30-20 rule. According to this thumb rule, you may allocate 50% of your income towards needs, 30% for wants and save the rest 20%. You can also tweak it according to your convenience. However, it is better to have a higher allocation of investment and savings in the budget.

Secondly, you can also identify your monthly expenses based on the past six months. Later divide your expenses into essential, non-essentials and junk. Use this list to priorities and cut whatever possible. You can also use budget apps to track your expenses. Also, invite every family member to share their concerns regarding the budget.

**Pay yourself first**

If you read financial blogs and books, you must have come across the concept of paying yourself first. Even before we receive our salary, many of us start planning ways to spend it. If you want to be free, you should consider paying yourself first. By this, we mean that you should earmark a certain amount of money for investing. You can also automate your investments. Set up a systematic investment plan (SIP), and you can see your money grow over time.

Another way to pay yourself is by investing in yourself through reading books, going to workshops etc. This will help you to increase your earning potential and to build a second source of income.

**Say bye to debt**

While people like to segregate debt into good or bad, there is nothing good about debt. There are harmful debt and less harmful debt. Having debt is one of the most significant impediments in financial independence. If you have many loans, look at reducing loans that don’t carry tax benefits. Otherwise, look at repaying the debt with the smallest principal. Once you can repay the smallest loan, you will be more charged up to clear your other debts.

**Get a financial advisor**

Last but not at least, having a financial advisor can immensely help you in this journey of financial independence. Everything you need to know about finance is available online. But, can you be sure that you will remain disciplined even when the market tumbles or when you are tempted to buy an expensive car to show off to your neighbor instead focusing on early retirement? Let’s face it that controlling our emotions are a lot harder. And that is why you need a financial advisor.

**A Friend, “Your Financial Life Partner”**

**97128 63430 – 86553 06591**

**Mutual Fund | PMS | Equity | Derivatives | Commodity | Financial Planning | IPO | FD**

**921, HomelandCity, Opp. J.H. Ambani School, Udhna Magdalla Road, Vesu, Surat. 395007**

**info@finoptical.com | www.finoptical.com**

Read More →

**Are You Financially Compatible with Your Partner?**

The wedding season is in full swing. Indian marriages are not just the marriage of two individuals but the entire family. While we tend to focus on the annual package and family’s financial situation, financial compatibility takes the backseat.

Financial compatibility, just like emotional compatibility, can help couples to live a fulfilling life with each other. Financial compatibility does not mean that both partners should have equal bank balance, but it is about how they see money and what money means to them. To understand financial compatibility, one needs to know the other’s attitude towards money. Some of the basic questions can be framed around outstanding debt, savings and spending habits.

Having a common point of view on money can help to keep money related issues at bay. After all, majority of fights after marriage tends to revolve around money.

However, no two people can be alike. Even though, financial compatibility in your relationship may not be great, you should not lose heart. Financial compatibility can be enhanced by following certain steps which will also deepen the bond with your partner.

**Know what money means to your partner**